Posted on April 23, 2018 by Brett

Sorting through key takeaways from a conference as large and diverse as LendIt Fintech USA is like trying to remember the highlights of a cross-country road trip. Fortunately, I chose one “road” to travel there – the small business lending channel. It was one of many channels offered during the conference April 9-11 at the Moscone Center in San Francisco.

Small business lending sessions covered:

The following are just a few impressions from attending the sessions.

One of most compelling sessions for me was the segment on Push Payments Set to Take Over Lending, which focused on how alternative small business lenders are adding products to tap more of their borrowers’ business. Speakers included Lisa McFarland, executive vice president and chief product officer of Ingo Money; Cecilia Frew, senior vice president and head of North American push payments for Visa; Kathryn Petralia, president and co-founder of Kabbage; and moderator JP Mangalindan, chief tech correspondent for Yahoo Finance.

That same day, Kabbage and LendingPoint had unveiled plans to offer push payments to borrowers. “Kabbage and LendingPoint each separately announced today that they will soon be able to get funds into their customers’ business accounts instantly and 24/7 via their pre-existing bank debit card,” reported Todd Stone in deBanked. “Hopes for this are not brand new. Last October, OnDeck announced a partnership with Ingo and Visa that would provide this convenience to borrowers, although this has not yet come to fruition, according to an OnDeck spokesperson.”

Zeroing in on the Kabbage announcement, David Penn in Finovate wrote, “Kabbage will use Ingo’s Push Platform, with its push-payments-in-a-box technology, to disburse loan payouts to customer accounts securely and in real time. The partnership between Kabbage and Ingo Money helps close the gap between business loan approval – which can be completed in minutes – and delivery of funds – which can take a day or more. Kabbage sees faster fund delivery as key to helping SMEs have better cash flow management and a compelling opportunity for small business owners. In its statement, the company pointed to a Visa survey that showed that small business owners, 70% of which own a small business debit card, would get a new card if real-time transfers were available.”

Intrigued with the discussion about this at the push payments session, I also stopped by Kabbage’s booth to learn more about how this will work.

The typical online small business lending transaction today creates a new digital agreement with the borrower for each individual business loan. Business loans are generally for six months or less. My understanding of the new Kabbage push payments is there will be an underlying master agreement that facilitates them. To me, this sounds similar in some ways to how a bank handles lines of credit.

Approved borrowers will be able to use their debit card for even the smallest purchases, on the spot. Let’s say a borrower is at a trade show and realizes more booth supplies are needed, he/she can buy supplies immediately with the debit card. Of course, there will be many other uses. Alternative lenders seem to be getting more comfortable with traditional lending methods and are focusing on distributing money even more quickly and efficiently to customers.

It is already easy to apply for a small business loan from your smartphone and secure the necessary funding. So alternative lenders are finding ways to gain a competitive advantage and, hopefully, attract more business. They are hoping that fast, convenient push payments will encourage increased borrowing. The debit card is the latest progress in this concept.

LendIt Fintech USA 2018 provided an opportunity to learn more about other industry developments. Collaborative lending platforms created by companies with groups of small business lenders are particularly interesting to me. The borrower submits a loan application to the platform and it is matched with the small business lender that is in the best position for the transaction.

This was discussed as part of The Future of the Bank/Online Lender Relationship session featuring insights from Sam Hodges, co-founder and chairman of Funding Circle US; Ryan Rosett, founder and co-CEO of Credibly; Rohit Arora, CEO and co-founder of Biz2Credit; Sam Graziano, CEO of Fundation; and moderator Bill Phelan, president and co-founder of PayNet.

Credibly is a small business online lender. Fundation seems to do quite a bit in different segments: they act as a small business online lender; help banks by re-engineering the small business credit delivery process, which drives more demand for banking products; and assist in developing solutions that partners serving the small business market can offer customers and clients. Funding Circle has a platform that connects investors with businesses looking for capital. Biz2Credit’s platform matches borrowers to sources of capital based on each company’s unique profile.

I see platforms like Funding Circle and Biz2Credit as a double-edged sword for participating lenders but also an inevitable development with a definite upside. On the one hand, lenders will get referrals they may not normally attract; on the other hand, they may lose some commissions because of the competition.

Overall though, this is an interesting and attractive business model. Overhead for the platforms is typically quite low and they are designed to respond quickly to changing business needs. Think of how StubHub brings together ticket buyers and sellers and it is all handled electronically with very little overhead for Stubhub. Or think of Uber. It makes sense that alternative small business lenders have adapted this business model, too.

I was impressed with the high quality of the session speakers at LendIt Fintech USA. Speakers included CEOs, presidents and COOs of large companies who you would normally only hear delivering a broad keynote address. The more intimate session settings allowed for specific discussions on small business lending with some of the top leaders in the industry.

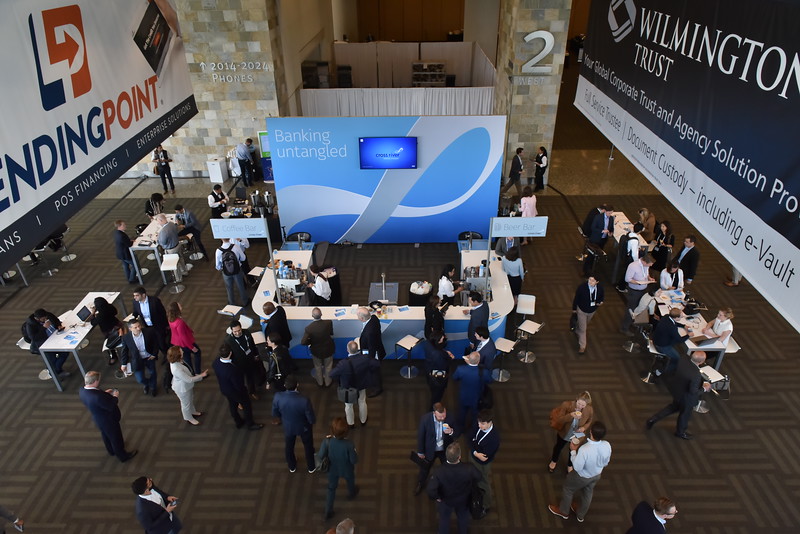

Speaking of intimacy, I was also struck by how the conference layout in the Moscone Center (Moscone West) made a huge show attracting thousands of participants seem manageable to navigate.

I would be remiss if I didn’t mention the many sessions devoted to financial blockchain technology during the event. There is certainly intense interest in this, and rightly so. But not everyone is equally excited about blockchain. I recall one keynote speaker saying blockchain in some ways seemed to be a solution looking for a problem.

For an overview of the event, here’s a great wrap up by Peter Renton, co-chairman and co-founder of the LendIt Conference, with links to some of the presentations: https://www.lendacademy.com/wrap-up-of-lendit-fintech-usa-2018/.

|

Brett Boehm is CEO for TBF Financial. He can be reached at bboehm@tbfgroup.com, phone 847-267-0660 or via LinkedIn. |