Posted on June 25, 2019 by Brett

We are riding the wave of an economic expansion in the U.S. now in its 10th year. Yet history tells us that all that rises must fall. More economists are warning of a slowdown. Some see signs of a recession coming our way.

Loan and lease defaults are low, but these will mount as the economy sputters. Most lenders and lessors will feel the impact. Hardest hit may be alternative lenders and other funders specializing in less-than-stellar credits.

Now is the time to reassess your company’s commercial loan and lease collections strategies. Are there small changes you can make that will produce measurable results today, and tomorrow?

One strategy that finance companies are using is to sell off all – or select segments – of their non-performing loans and leases at charge-off. This strategy offers benefits to equipment lessors, fintech lenders and banks regardless of the economic cycle. There are ways to sell off your commercial debt that accelerate collections, generate revenue for your company and – yes – preserve customer relationships.

Economic Predictions

I am not an economist but, like you, have been keeping up with the data and commentary. Overall the economy is still growing. We are enjoying the lowest unemployment rates in years. But a number of economists are reporting headwinds.

A National Association for Business Economics survey of 53 economists in May revealed that the risk of a recession beginning in 2019 is perceived to be low, about 15%. But the economists predicted that the risks would climb to 35% by mid-2020 and to 60% by the end of 2020.

“The consensus forecast calls for real GDP growth to slow from 2.9% in 2018 to 2.6% in 2019, and then to 2.1% in 2020. While the panel has turned slightly more optimistic about the outlook since the previous survey, 60% of panelists still view risks to the outlook as tilted to the downside,” NABE President Kevin Swift, chief economist for the American Chemistry Council, noted in the report summary. Survey Chair Gregory Daco, chief U.S. economist for Oxford Economics, added that, “Increased trade protectionism is considered the primary downside risk to growth by a majority of respondents, followed by financial market strains and a global growth slowdown.”

Most economic forecasts I’ve read are similar, predicting continued expansion for the short term and a recession starting in the next year or two.

Delinquencies & Defaults

Delinquencies, defaults and charge-offs are low. But the numbers in some cases are climbing, and they will certainly rise in the event of an economic downturn.

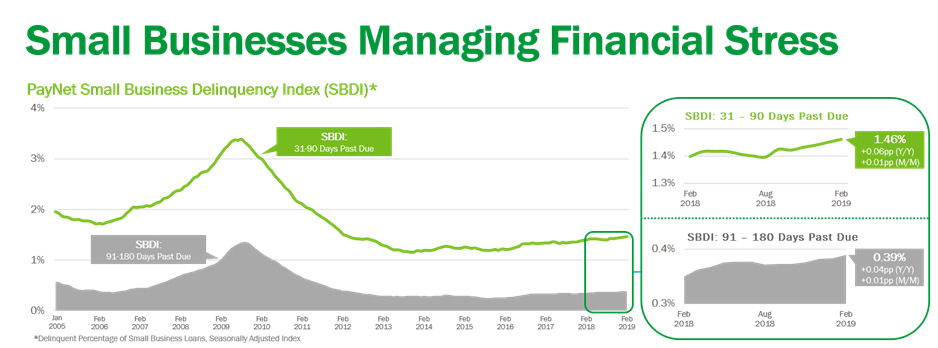

One trusted source, PayNet, recently reported that delinquencies for small business loan payments had reached a seven-year high, rising 0.10 percentage point to 1.52% from April 2018 to April 2019 for accounts 31-90 days past due, and 0.02 percentage point to 0.39% for accounts 91-180 days past due

While the next economic slowdown may not be as dramatic as the Great Recession of December 2007–June 2009, notice the delinquency rates for the years leading up to, during, and immediately following it in the PayNet chart. Delinquencies were significantly higher than what we are experiencing now. Even with a more modest bump in the future we can expect added strain on internal collections teams.

So, what’s the story on actual defaults of small business loans? PayNet is forecasting that the 1.9% average for all industries in 2018 will rise to 2.3% in 2019 and 2.5% by 2020. Of course, not all defaults end in charge-offs, when a past due payment remains unpaid for 180+ days. Some accounts are recovered before charge-off. But we can expect charge-offs to accelerate along with any uptick in defaults.

Another trusted source of information is the Equipment Leasing and Finance Association, which surveys members frequently. Charge-offs currently are low in the industry. Average losses as of a percent of net receivables in April 2019 were 0.32%. Nothing here to sound alarms yet but a significant increase in charge-offs is only a matter of time in the event of an economic slowdown. ELFA data also tells us charge-offs can sometimes fluctuate significantly from month-to-month, such as December 2018’s reported 0.55%, creating yet another stress point for internal collections departments.

Debt Selling & Buying

Companies using commercial debt selling strategically in their businesses include equipment lessors, banks and, increasingly, alternative (fintech) lenders. It is an accepted and established practice. Commercial debt selling accelerates collections by empowering staff to concentrate on accounts that are earlier in the past-due cycle. It also generates immediate revenue.

How does it work?

Lenders and lessors start by finding a commercial debt buyer to serve their business. As in any industry, there are reputable vendors to choose from, but others cut corners. We recommend using a checklist to make the vetting process simple and efficient. Following a checklist will ensure you are dealing with a reputable buyer or buyer’s broker with recent success serving companies like yours.

Next, determine the optimum timing for your company. We advise most finance businesses to sell non-performing loans and leases (NPLs) at the charge-off (past due 180+ days) stage. This is usually the point when it is least efficient and cost-effective for internal collections to continue chasing the accounts.

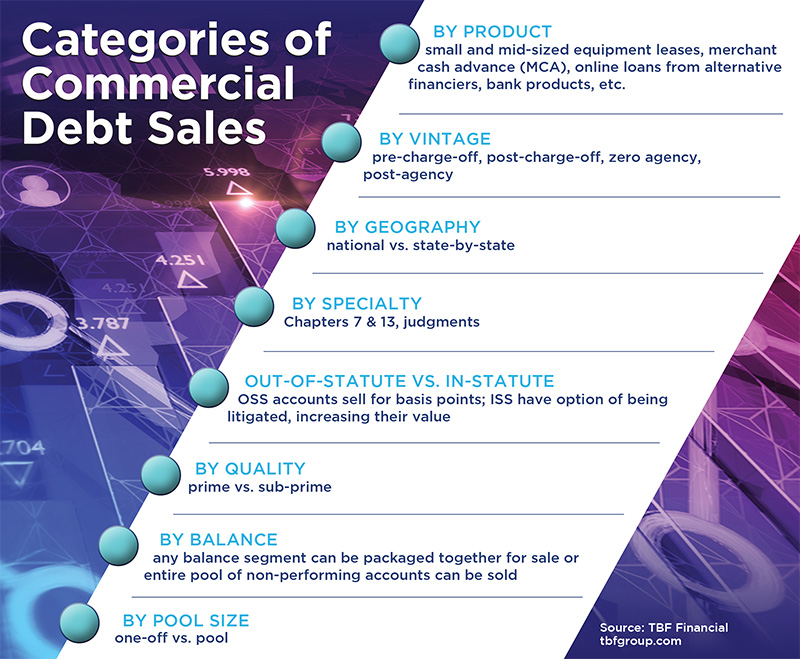

Some companies sell off all their NPLs at charge-off. Others sell off all except for certain ones they litigate, or they sell off specific categories of debt. We’ve created a chart to show the different categories lenders use in determining what to sell.

Once this decision is made, your commercial debt buyer will need basic information on the assets being sold. He or she will review the information and make an offer. Your company (the lender) then signs the purchase agreement and is wired payment. How long does this take? With our commercial debt buying company, for example, customers who have established forward-flow relationships with us often handle the process online and are wired payments within 24 hours.

Preserving Customers

Lenders and lessors want to know that their debtors will be dealt with fairly. It’s good business. They also hope that the debtor will, someday, return as a solid customer. We couldn’t agree more. It is important to ask commercial debt buyers what happens to your accounts post-sale.

At our company, we work diplomatically with debtors to collect what we can over time, using our name and not representing ourselves as part of your company. And we do not re-sell the accounts. This gives our sellers added protections. Not all buyers offer this, so make sure your buyer does.

Questions?

Regardless of whether you plan to do business with my company, I am available to answer questions about commercial debt buying and selling. I look forward to hearing from you.

|

Brett Boehm is CEO for TBF Financial. He can be reached at bboehm@tbfgroup.com, phone 847-267-0660 or via LinkedIn. |