Posted on June 26, 2019 by Brett

We are nearing the end of the quarter and the conclusion of the fiscal year for many companies. If you are involved in lending or equipment finance, someone in your business probably is taking a fresh look at the year’s non-performing loans and leases (NPLs). Your company may be exploring smarter options for the year ahead.

The latest issue of the National Equipment Finance Association’s Newsline includes an article covering one such option: commercial debt selling. It’s a strategy that banks, equipment finance businesses, online small business lenders and merchant cash advance companies are using to manage risks and generate revenue from NPLs.

The article is by yours truly. I was excited to contribute it and to discuss commercial debt selling and buying at the NEFA Funding Symposium. At TBF Financial we are passionate about helping our clients with NPLs and I appreciate having opportunities to educate companies about commercial debt selling options available them.

Just follow the article link for an overview of how commercial debt selling works. The article also covers pros and cons compared with alternatives, tips on vetting buyers and brokers, and reasons that now is the time to reevaluate strategies for handling NPLs. Chances are we are at the end of a market cycle, where defaults are historically low but are destined to rise.

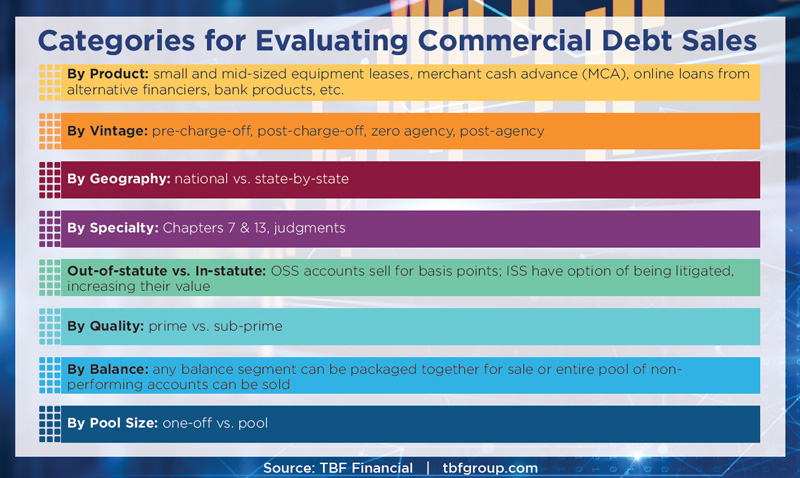

Two questions I often am asked are 1) How does a company determine what to sell? and 2) What is the best timing? So, I put together a chart to summarize the categories that companies typically use to make this evaluation.

In other words, some sellers designate specific product categories that will be part of the sale. Others focus on certain geographies, specialties, balances, pool size and/or other criteria.

Best timing in the lifecycle of an account? We have found that many finance companies use commercial debt buying services to sell off accounts after they have gone into default and been charged off. This seems to be the sweet spot for companies because collection attempts have run their course by this point. We have some customers who sell off all their accounts after charge off, while others sell off accounts below a certain value and litigate those above.

Another question I often hear is, “How can I preserve customer relationships and maintain control over accounts after they are sold?” This is easy if you are dealing with a reputable, experienced buyer. The NEFA Newsline article discusses specific ways to make sure that you are working with the right commercial debt seller for your business.

Thanks to American Dream Machines and cars.com for permission to use their photo of this beautiful 1966 Corvette Sting Ray.

|

Brett Boehm is CEO for TBF Financial. He can be reached at bboehm@tbfgroup.com, phone 847-267-0660 or via LinkedIn. |